Binance Earn: A One-Stop Earning Hub?

1. Savings

There are no deposit fees and earnings (APR or AIR) are stable.

-

Flexible Savings Flexible Savings product subscriptions and redemptions are closed during 23:50-00:10 (UTC) daily. No interest is accumulated on products purchased on the day of subscription. Interest is calculated the next day.

Probably the lowest risk option. Do note of the saying, "Not your keys, not your crypto."***

There are 233 assets available on this type of crypto savings. One can choose to auto-subscribe to any of these and interests earned or any available amount in the Spot wallet will be added automatically to the savings daily. When the auto-subscribe is not enabled, the daily interest will accumulate in the user's Spot wallet.

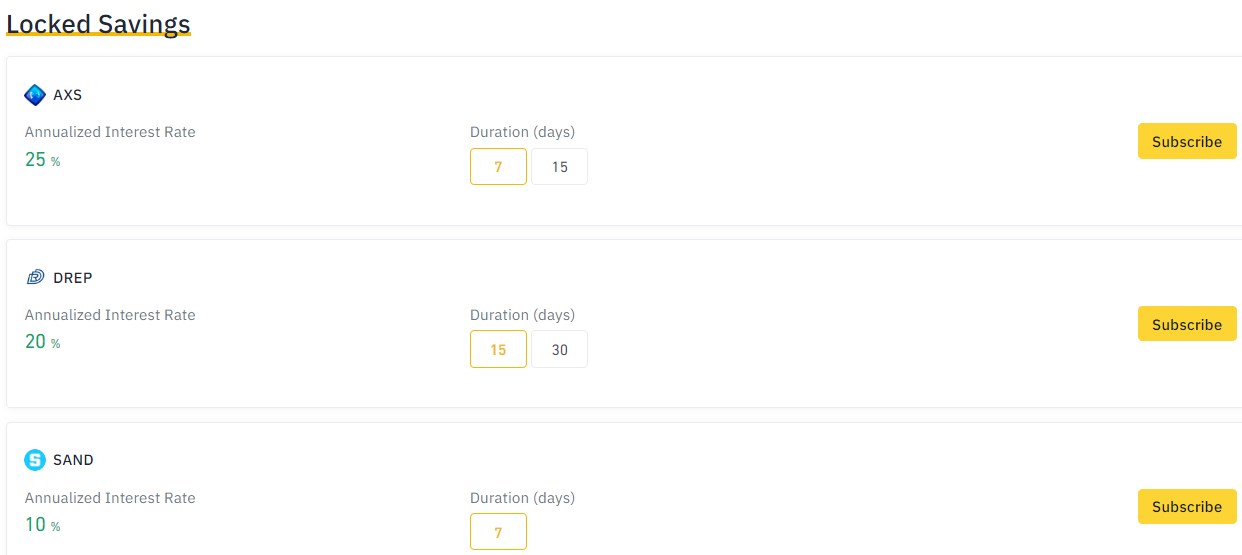

Currently, there are 13 assets available with varied Annualized Interest Rate (AIR) from 5% to 35%. Crypto [assets](https://leofinance.io/@leoglossary/leoglossary-asset) can be withdrawn immediately after the chosen lock period.

-

BNB Vault Staking BNB to earn combined rewards from Flexible Savings and Launchpool. Assets staked in the vault can be redeemed anytime.

Rewards are distributed daily to the user's Spot wallet. If Auto-Transfer is enabled, any available balance in the Spot wallet will be used daily at 02:00 and 20:00 (UTC + 0) to subscribe to the BNB Vault.

There are no new projects in the Launchpad or Launchpool so any BNB staked in the vault only earns a paltry APR of 0.35%.

-

Auto-Invest "Auto-Invest allows one to automate crypto investment and earn passive income. It is a dollar-cost averaging (DCA) investment strategy.

You can choose the cryptocurrency you want to purchase on a regular basis. Your purchased crypto will be automatically deposited into your Flexible Savings account, so you can earn passive income with your investments." - Quoted

There are different timeframes (short-term to long-term) to choose from: 7days, 3months, 6months, 1year and 3years.

One can pause, stop (remove) and redeem auto-invest subscription anytime. More information on the FAQ section.

2. Staking

-

Locked Staking (Low-entry, high yield. Can start with as low as $10.) Both PoS tokens and non PoS tokens are possible to be included, with various sources of income, included but not limited to the blockchain rewards, interest compensation, marketing events plan,etc. The value of staked funds fluctuates and is subject to change. - Source

Staking interest is distributed on a daily basis. Redeemed principal will be returned to Spot wallet within 48-72 hours due to different global timezones.

Lock up period for regular products is 1 day (Flexible Lock). Other timeframes are 30days, 60 and 120 days.

Early redemption will deduct all interest based income. It will take 48-72 hours for tokens to be credited back to Spot wallet due to different global timezones.

On-chain rewards are regularly distributed in the form of BETH to all participants' Spot wallets based on their BETH position.

One can participate by staking [DOT](https://leofinance.io/@crypto-guides/what-is-polkadot-coin-dot) for the projects one wants to support during the 5 round auction intervals and then get rewarded with crypto.

<em>Participants will receive the Binance Extra Bonus provided by Polkadot parachain projects during the Warm-up Period </em>(approximately 30 million USD of rewards)<em>, and 100% of all rewards from your favored projects during the Auction Period and Lease Period.</em>

<em>Projects that win the slot auction will lock the staked assets according to the project's lease period, and Binance will start distributing rewards to participants based on the Rewards Timeline. - [Source](https://www.binance.com/en/dotslot)</em>

More details about this are found [here.](https://www.binance.com/en/support/faq/1d6025c85e7447a181da19fcffbcd8d4)

3. Farming

-

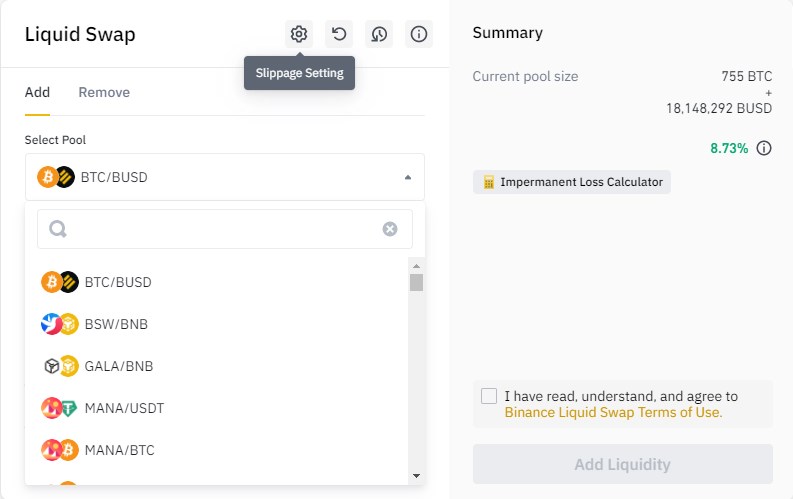

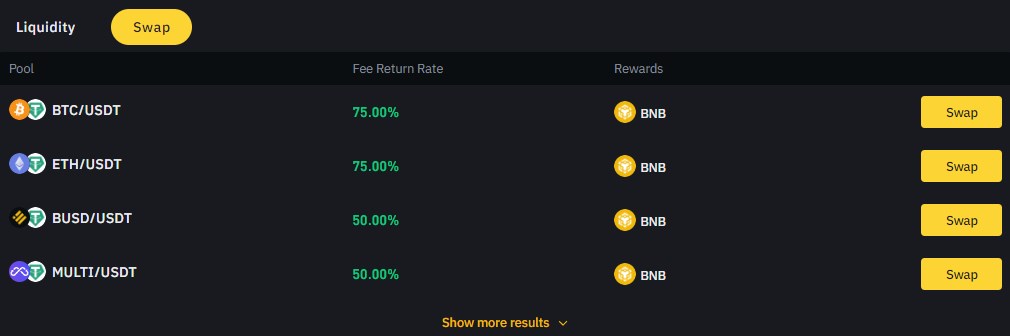

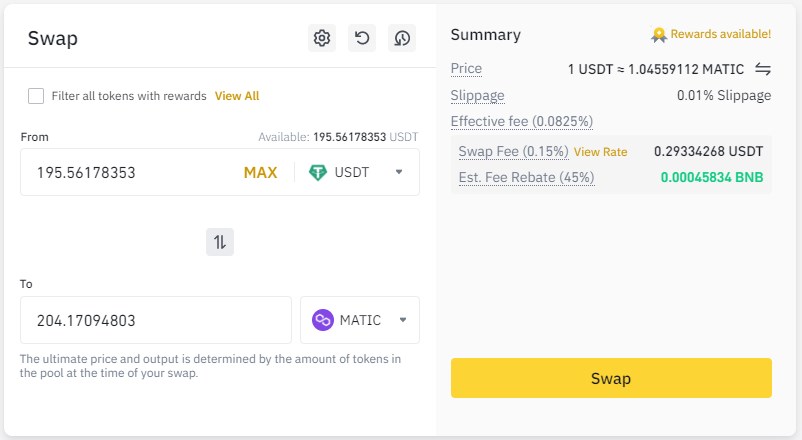

Liquidity Farming Provide liquidity to earn transaction fees and farm rewards in BNB token. There are many pairs/Liquidity Pools available.

4. Dual Investment

Buy Low or Sell High; Wide Selection; No Trading Fees; High Rewards, High Risk.

-

One may lose more cryptocurrency than initially subscribed.

-

APR is always changing and this is majorly dependent on the target price, remaining deposit days, and also price volatility. But once you have subscribed to a Dual Investment product, the APR will be locked in throughout your deposit days and will not change thereon.

-

Cannot be redeemed early.

-

There are 13 underlying assets available for this type of investment.

-

One has to complete a short quiz and must score a full mark before the next step for participation.

Amongst the above, I've only been able to try the Flexible Savings, BNB Vault, Binance Launchpad and Launchpool. With my risk appetite being low, I didn't dive into the other opportunities that the Binance Earn offers.

DISCLAIMER: None of these are to be considered endorsements or investment advice. Do your own due diligence. Thank you.

Images/screenshots were from Binance. No copyright infringement intended. 300722/10:10ph

Posted Using LeoFinance Beta